The Company aims to fulfill environmental protection and social harmony while maintaining economic growth. We also support the 17 Sustainable Development Goals of the United Nations and play an important role in promoting sustainable finance. The Company has paid close attention to global sustainability issues and industry trends and aims to offer appropriate financial instruments and FinTech innovations to help customers reduce their impact on the environment. We also actively help companies uncover new opportunities in the industry and achieve sustainable development of the society.

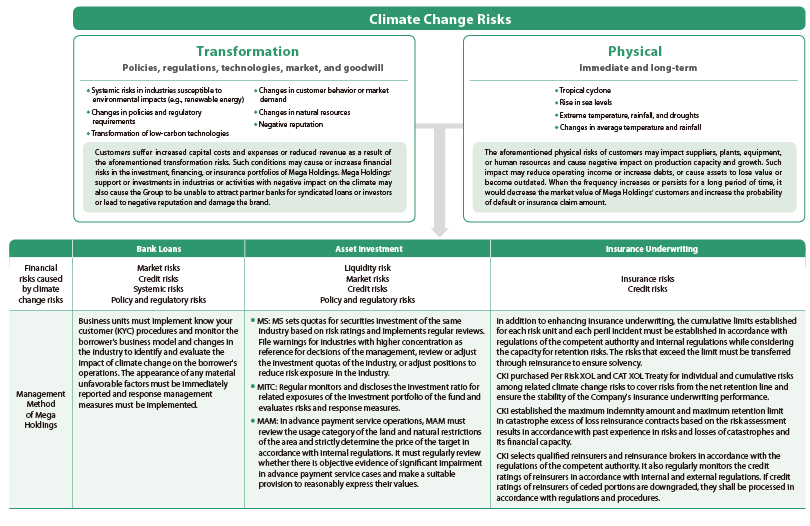

To respond to the trend in risks exposure, Mega Holdings included the management of emerging risks (including climate change risks) into the "Risk Management Policy and Guidance Principles" of Mega Holdings and subsidiaries to respond to the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). We identified and inventories climate change risks and opportunities and identified and managed these risks to strengthen green finance actions. The Group officially signed the TCFD in April 2020 to actively respond to the risks and opportunities of companies brought forth by climate change.

Mega Holdings' Governance Framework

Mega Holdings established the Risk Management Committee under the Board of Directors and designated the Risk Management Department as the unit responsible for risk management. To respond to the trend in risks exposure, the Board of Directors passed the proposal for including climate change risks as emerging risks and included them into the "Risk Management Policy and Guidance Principles" of the Company and subsidiaries in the meeting in June 2019. Subsidiaries are required to report material risk issues (including emerging risks) to the Board of Directors of Mega Holdings and the Risk Management Committee.

The President of Mega Holdings serves as the highest-ranking manager of related climate risks and opportunities of the Group and subsidiaries. At the end of 2013, the Company set up the Corporate Social Responsibility Committee, where the President of the Company acts as the chairperson, the Directors, Senior Executive Vice President of the Company acts as the executive secretary, and presidents or executive vice presidents of subsidiaries act as the members. The Corporate Social Responsibility Committee is divided into five Working Groups. At the beginning of each year, each Working Group shall submit the specific implementation plans and results to the CSR Committee and Board of Directors. For the management of climate change risks, a list of follow-up implementation status shall be specified in the CSR implementation plan and reported to the members and Chairperson of the CSR Committee.

Sustainable Environmental Investment Policy

In 2019, MICB and MBF included information on whether borrowers have fulfilled responsibilities for environmental protection, their involvement in activities or incidents against the interests of the public, and actions or incidents in violation of human rights into the credit review operating system. Business units audit and provided remarks for the disclosure of all applications. Those that involve adverse news or other risk issues must be provided with sufficient explanation for the occurrence and improvement status to be used in the review procedures for assessing the approval, additional restrictions/commitments, reduction in loan amount, or rejection. They shall also be used as the reference or basis for related risk management.

MICB established the "Credit Extension Guidelines" and included the spirit of the Equator Principles and Principles for Responsible Investment (PRI) into the credit review procedures to review all compliance status of related environmental protection regulations of the borrower. The credit extension policy expressly requires "pay attention to customers on whether they have fulfilled environmental protection, ethical management, and corporate social responsibilities as the basis for granting loans" and guide customers to fully implement environmental protection and CSR obligations. MBF implements sustainability investment and held NT$3 billion of green bonds as of the end of 2019. It also plans to purchase approximately NT$1.56 billion in green bonds in 2020. In terms of compliance with international standards and principles, MBF complies with the Green Bond Principles (GBP) established by the International Capital Market Association (ICMA) and the Climate Bonds Standard (CBS) established by the Climate Bond Initiative (CBI). MS assists environmental protection and renewable energy industries raise funds, develop the industry, and reduce the damage of the environment in accordance with the "Standard Operating Procedures for Primary Bond Markets". CKI expressly specify in its "Regulations on Investment Management Procedures and Operations" that if an investee fails to implement anti-money laundering and counter terrorism financing operations and fulfill environmental protection, corporate ethics, and social responsibilities, CKI shall reduce or terminate investments in the investee operations at an appropriate time. In addition to considering the business conditions of the investees, CKI also considers whether they have published CSR reports and whether they have conducted inappropriate activities that affect the society. CKI also learns about the operations business conditions of the investee by collecting information and participating in its investor conferences and shareholders' meeting.

From July to December 2019, MICB had 4 loan cases in which the borrower was still implementing improvement measures due to the failure of the borrower or a subordinate company of the borrower to fully fulfill duties for environmental protection. It also had 2 cases in which the borrowers were involved in activities or incidents that damage the public interest. In 1 case, the borrower was prosecuted for offense against public safety due to building engineering. Although the borrower was ultimately not indicted after investigations, its loan application for NT$4 million has not been approved. From July to December 2019, MBF had 8 loan cases in which the borrower was still implementing improvement measures due to the failure of the borrower or a subordinate company of the borrower to fully fulfill duties for environmental protection. It also had 8 cases in which the borrowers were involved in activities or incidents that damage the public interest and 4 cases in which the borrowers had committed actions or caused incidents that infringed upon human rights. There had been no cases of rejections of loans.

Mega Holdings strengthens the cultivation of green finance talents through both seminars organized by the Group or participation in external training programs. A total of 59 employees from MICB, CKI, and MBF participated in the renewable energy finance business training courses in 2019 and total hours amounted to 268.1 hours. The courses included the trends and future prospects of the solar photovoltaic power industry, training of solar photovoltaic and offshore wind farm financing business talents, and innovative strategies and applications for green finance.

Climate Finance Risks and Opportunities

Ernst & Young, Taiwan Stock Exchange Corporation, Taipei Exchange, Taiwan Institute for Sustainable Energy (TAISE), and other entities jointly organized the "TCFD Recommendations Traditional Chinese Version Publication Ceremony" in October 2019. Jui-Yun Lin, Executive Vice President of Mega Holdings, took part in the translation working group throughout the process. Participants actively took part in the publication ceremony and attendees shared their experience in the promotion and operation of TCFD Recommendations. Their participation demonstrated the commitment of Taiwanese enterprises for responding to climate change and creating a sustainable financial and business environment.

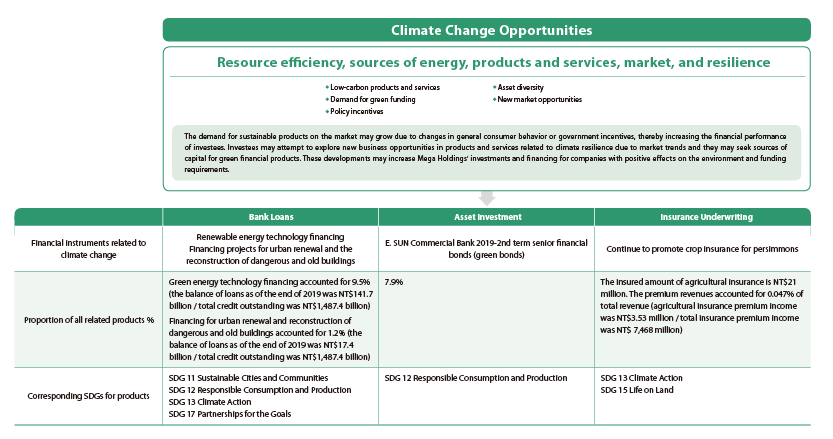

The risks and opportunities of climate change on loans, investments, insurance, and other businesses include direct or indirect financial impact caused by extreme weather on entities exposed to risks, changes in regulations, production technologies, or market demand, and the impact of other factors on company operations. In response to the impact of climate change on economic activities and economic demand, MICB has included emerging climate risk factors in all procedures in the credit risks management of corporate or personal loans including the credit investigation, review, maintenance of collaterals, and post-loan management. MICB seeks to fully monitor credit risks, protect operating profits, and seek opportunities for the development of new businesses. The investment risk management of all subsidiaries include the prospects and risks of the economy, market, industry, and individual companies as well as emerging risks such as climate change in the formulation of the investment strategy, selection of investment targets, management of the investment portfolio, implementation of stop loss and profit mechanisms, and maintenance of liquidity in order to seek appropriate opportunities for investment and profitability.

Investment Indicators for Climate-Sensitive Industries

Mega Holdings has identified climate investment indicators for customers in four major sectors: Energy, transportation, materials and construction, and agriculture are climate-sensitive industries and they are separated into 13 different business categories. As of the end of 2019, the total amount of loans to the 13 business categories among the loan businesses of MICB and MBF amounted to approximately NT$729.2 billion or 44.0% of all total credit outstanding of MICB and MBF. Among these business categories, the total credit outstanding of the real estate industry was highest, accounting for 35.7% of the sum of the 13 business categories. It is followed by transportation services with 18.2% and mining/metals/steel with 11.4%. In terms of asset investments, the investment of the 13 business categories by MICB, MBF, MITC, and MS as of the end of 2019 totaled NT$28.8 billion, which accounted for 19.0% of the total investments of the four subsidiaries. The chemicals industry accounted for the highest proportion of 17.8%. It is followed by real estate enterprises, power generation enterprises, and transportation service enterprises, each of which accounted for 15% or more.

The Company aims to fulfill environmental protection and sustainable development while maintaining the economic growth. To achieve this goal, green finance plays an important role in linking the financial industry, environmental protection, and economic growth. The Company has paid close attention to climate change and industry trends and aims to offer appropriate financial instruments that help stakeholders reduce the impact of climate change and find new business opportunities, so as to mitigate global warming and achieve the sustainable development. Based on major government policies, including nuclear-free homeland, energy transition, and emission reduction, the short-term goal of the Company is to fund renewable energy businesses so as to facilitate the smooth development of the financial market; the long-term goal is to increase the awareness of renewable energy among industries, investors, and consumers by taking environmentally-friendly measures with subsidiaries to reduce the risks of investments and financing for climate-sensitive industries.