In response to the global FinTech trends, Mega Holdings is committed to the development and innovation in digital finance. We continue to research and develop innovative services and optimize processes to "accelerate the digitization of branches", "improve the service experience of digital channels" and "enhance AI and big data capabilities" to achieve digital finance development. Mega Holdings prioritizes customer needs and experience when planning digital services and processes. In recent years, the Group has continued to promote mobile services and worked closely with its banking, securities and property insurance subsidiaries in cross selling and integration of the Bank's digital deposit accounts. We launched the digital securities account opening and online travel insurance functions to expand the Group's financial service experience and maximize synergy.

Online Financial Services

MICB's online banking is designed based on a customer-oriented approach. Through data collection and analysis of network traffic and remote user perception, the menu, name and the structure of online banking are fully adjusted to optimize user experience. At present, there have been 980,000 online banking accounts with a total transaction amount of NT$ 21.5 billion per month.

MICB AI Big Data Analysis

● Enhance AI big data analysis and increase the value of data

Data analysis and applications are some of the core competencies for the finance industry to achieve long-term development and maintain competitive advantages. Mega Holdings has established a data analysis team to independently develop and analyze various data applications. In addition, Mega Holdings integrated internal transaction records and external open data sources to enhance the diversity of the database. We continued to expand the contents of data and completed the online real estate appraisal system and activation operations as we attempt to adopt different business analysis approaches to uncover potential business opportunities or risks for early preparations.

● Increase Precision Marketing for Target Customer Groups

Mega Holdings collects customers' digital channel interaction data and compares them with external media browsing data to analyze customer preferences and predict financial products that meet their needs. We also analyze product features, marketing target conditions, and other information for each marketing campaign to focus on the target audience and increase the customer satisfaction rate and conversion rate.

Enhance Digitalization Services for Bank Branches

● Establishment of the Financial Confirmation Blockchain Platform

Traditional confirmations must be mailed via registered mail and provided with a return mail envelope. Each confirmation takes an average of 3 days to complete. MICB connected to the blockchain confirmation system of Financial Information Service Co. Ltd. to reduce manual operations and costs of branches. We established an automatic confirmation platform that integrates the business system databases and significantly reduced confirmation response time to "immediate" response. It effectively reduces manual processing time and makes full use of "paperless" environmental protection effects. We processed 8,487 confirmations via the blockchain in 2019.

● Establishment of the STM (Smart Teller Machine)

The STM is a unique and innovative service provided by MICB. All verification operations required for account opening procedures were digitalized and standardized to accelerate overall review time. Since the launch of the STM, we have significantly reduced the operation time required for opening accounts over the counter from an average of 60 minutes to 19 minutes. We also integrated multiple documents required for account opening and effectively reduced the use of 274,320 sheets of printed documents. We deployed 77 STMs in 2019 and provided services to 13,356 people who opened 15,240 accounts. The service has increased the digital service effectiveness of the branch and thereby improved customer service experience.

Improving the Service Experience of Digital Channels

● Promote mobile payment services to satisfy customer demand for mobile shopping

The popularity of mobile networks has increased customers' use of mobile phones for various transactions. MICB continues to develop mobile financial services and adopted dual development strategies which included the launch of Taiwan Pay and partnerships with electronic payment companies (JKOS, O'Pay, Gama Pay, and EasyCard) in connecting accounts for payment. We have established a mobile ecosphere by understanding customers' lifestyles and enhancing cross-industry collaboration. It has enhanced Mega Holdings' mobileservice image and the added value of deposit accounts. Close to 290,000 users have used the services in 2019.

● Use real-time account notification services on social media platforms to increase customers' financial independence

MICB's LINE official account provides 14 account notification services and issues an average of 2.4 million notifications each month. In addition to saving 72% of the cost of the SMS delivery, customers can also actively inquire foreign exchange rates, service locations, credit card services, and mortgage calculations on the MICB LINE official account. They can also use online text customer services to ask questions and receive answers. As of the end of 2019, 2.72 million people have joined the account.

MS continues to operate official accounts on social media including Facebook and LINE. In addition to providing financial news services on the two major social media platforms, it also provides push notifications for customer-selected stocks and news on purchased stocks, real-time transaction price and volume alerts, transaction reports, various account inquiries, and exclusive services. MS also provided connections between the LINE official account and MS's trading system to implement limited-price orders and help investors gain opportunities in trading. MS's LINE official account currently has 33,795 members.

● Digital Deposit Account MegaLite

After opening accounts online, customers may enjoy services for deposits, wealth management, foreign exchange, and transaction fee concessions, which saves time and paper consumption. MICB enhanced the promotion of the MegaLite NTD and foreign currency digital accounts in 2019 and provided preferential demand deposit interest rate as well as 0.5% rebate for interbank remittances and automatic credit card payment deduction, and discounted service fees for "micro wealth management funds" to encourage individuals with limited assets to save money for wealth management and accumulate wealth. At present, there have been approximately 36,000 NTD accounts and 21,000 foreign currency accounts.

● Mobile Online Exchange Settlement Services

MICB created the first online exchange settlement services to provide people with 24-hour online cash exchange services for 18 foreign currencies. To meet customer demand for mobile services, MICB completed the mobile access to the online exchange settlement website in July 2019 and used RWD technologies for consumers to complete exchange settlement transactions on their mobile phones with ease. MICB also enhanced the integration of online banking services and used the Single Sign On (SSO) mechanism for online banking users to quickly access the online exchange settlement website for direct transactions.

Mega Holdings introduced the eDDA digital authentication functions of Taiwan Clearing House to expand the convenience of mobile services. Consumers can use inter-bank demand deposit accounts to deduct payments and complete payment operations after issuing an order on the mobile phone. This has accelerated overall transaction speed and experience. According to past statistics and data, more than 95% of customers use ATM or online ATM for fund transfers. The number of authorized electronic payment deductions in this service has reached 24% of total transactions. The growth is rapid.

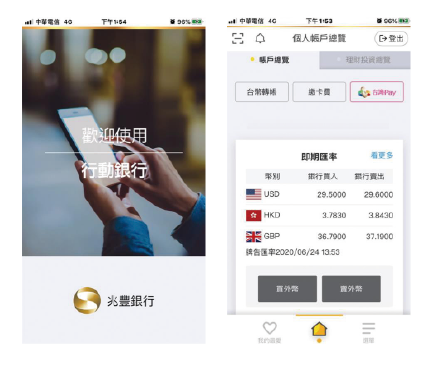

Mobile App Platform

MICB continues to promote the mobile banking app with functions that include Taiwan Pay, rapid login with bound devices, integrated account inquiries, NTD/foreign currency account transfers, online payments, mobile payments, cardless withdrawal, online wealth management, credit card services, online pre-paid foreign currency and traveler's checks, cloud-based counters, and online customer services.

As of the end of December 2019, there have been a total of 620,000 accounts on mobile banking with a 22% growth compared to 2018.

CKI launched a mobile app in 2018 to provide insurance policyholders with "online payment", "online insurance purchases", "accident site self-assistance", "claim application", and "convenient online survey" services. It also continued to optimize the app in 2019 to provide customers with convenient real-time services.

MS's "Digital Account Opening 2.0 Project" was launched in January 2020. It is different from the current video conference account opening app service and it provides two types identity verification and account transfer services with a bank card or online banking certification. It is a one-stop account opening service that does not require the customer to visit a branch. MS also implemented the "Securities Welcome Robot Project" which made use of natural language processing (NLP) and robots to provide onsite customers with inquiry services for financial products, price trends chart, and interactive Q&A services for finance-related questions.

Innovative Service of Credit Card

MICB has digitized credit card services and credit card applicants can provide additional documents via app to save time. A responsive webpage for online credit card applications was established in 2019 so that customers can easily use smart phones, tablets, or computers for applications. The webpage is convenient to browse and it greatly shortened application procedures to meet customer demands. The mobile billing service was launched in June 2019 for customers to view bills and pay credit card bills on their mobile phones with greater ease. They can also apply for automatic fund transfer payments online. In addition, the smart customer service system added online human text services to facilitate the transformation of traditional finance and added functions such as available credit limit inquiries for credit cards and credit card billing services. As of the end of 2019, users have used the "smart customer service system" 487,558 times and the accuracy rate of responses was 92.1%.

Air pollutant and environmental protection issues have gradually gain prominence. To respond to the government's call for marketing only electrical scooters by 2035, MICB issued the "Gogoro Co-Branded Card" with the leading electric scooter company Gogoro in September 2018 to jointly promote the development of the electric vehicle industry in Taiwan, reduce greenhouse gas emissions, and reduce the impact of mobile pollution sources on the environment. More than 70,000 Mega Bank Gogoro Co-branded cards have been issued since its launch. It became the first credit card in the world capable of unlocking an electric scooter and it was selected as the Best Credit Card Taiwan in 2019 by the "International Business Magazine". The number of Gogoro Co-branded card has quadrupled as of the end of 2019 from the previous year and the average valid card rate exceeded 84%. Its performance has been spectacular.

Smart AI Applications

MS integrated innovative technologies and artificial intelligence and continued to create actual applications and settings for FinTech. It introduced machine learning (ML), natural speech processing (NLP), chatbot, and service robot technologies. In 2019, it employed AI in financial products and services including the "Mega Wealth Management Secretary", "smart customer service on the official website", and the "Welcome Robot Hsiao Pei".

Open API Services

MS provides domestic securities, futures, warrants, and foreign futures quotation and transaction API services to respond to programmed transactions and open API trends. It also supports coding and connection documents for programming languages such as Python, C#, C++, VB, and Delphi, providing investors capable of programming transactions with more convenient and faster transaction methods.

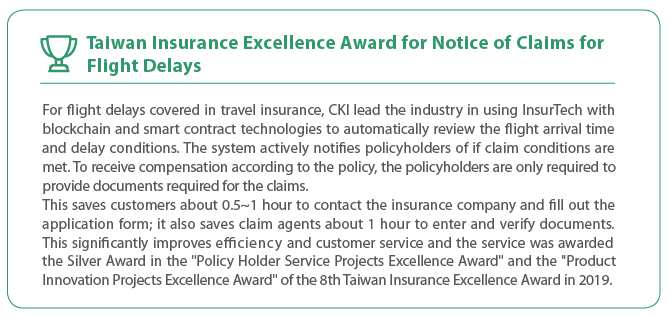

Online Insurance and Automatic Claims

Mega Holdings allows customers to purchase property insurance online and a mobile app was launched in June 2018 to allow customers to purchase insurance and enjoy convenient services anywhere and at any time. In 2019, the number of insurance policies purchased was about 20,735 which was an 82.25% growth compared to 2018.

CKI launched the "Persimmon Insurance" automatic claim mechanism with the assistance of the Council of Agriculture of the Executive Yuan to fulfill corporate social responsibility and protect persimmon farmers. When the typhoon wind speed and cumulative rainfall statistics for five consecutive days announced by the Central Weather Bureau exceed the standard values for filing claims, it actively contacts persimmon farmers without implementing individual surveys on losses. It uses credible data to reduce the number of potential disputes in the claim process and reduces the economic losses caused by typhoons or torrential rain to provide persimmon farmers with more protection.

Mega Care yoUBI

We received the approval from the Insurance Bureau of the FSC for the "CKI Automobile Insurance Mileage Payment Calculation (UBI) Clause" at the end of December 2018. The product uses the exclusive "Mega Care yoUBI" app to automatically launch the human and vehicle identification mode of the app's vehicle-mounted device when the user starts the engine. This is the first application in the domestic property insurance industry that truly automatically records the mileage and driving behavior of drivers. We have obtained a patent from the Intellectual Property Office of the Ministry of Economic Affairs for the technology "human and vehicle identification system used for vehicles". The introduction of the system helps the insured understand their driving habits and increase safety, creating spillover effects beyond the insurance policy. The project is currently being implemented.

IoT Big Data Analysis

CKI participated in the plan for the establishment of an innovative service platform based on IoT big data analysis for the insurance industry in the digital economy program of Tsing Hua University and the Ministry of Science and Technology in 2019. The preliminary plan involves a partnership between the Company, Tsing Hua University, and the dash am manufacturer mio. The AI technology trained by the University is used to read dash cam images to provide rapid claim services for small amount motorcycle insurance products.

Financial Patents

MICB continuously develops innovative services and optimizes procedures. It encourages employees to develop digital finance products and patents to increase overall competitiveness. In 2019, MICB applied for 185 patents on digital finance, 137 patents of which have been approved and 42 were awarded invention patents. MICB continues to maintain its number one position in the domestic finance industry. The types of patents mainly included FinTech applications, information security, mobile platforms, and big data. Mega Holdings applied for 3 patents on risk management in 2019 and the 3 patents for a risk management technology application system were approved. Another invention application is still being reviewed.

In a future world of FinTech and digital transformation, we will continue to introduce new technologies to connect to all professional operations in finance such as continuing to optimize digital account opening functions, integrating optical character recognition (OCR), automatic identification of identity certificates uploaded by customers, and automatically load fields for account opening to reduce input time for customers. Mega Holdings also introduced Robotic Process Automation (RPA) to reduce the demand for human labor and reduce human errors by using automation to complete repetitive and dull computer desktop operating procedures. Mega Holdings works with other start-ups to file applications to the competent authority in the form of a regulatory sandbox to implement financial innovations and use new technologies for providing customers with the fastest and most comprehensive financial services.