Five-plus-two Key Start-up Industries

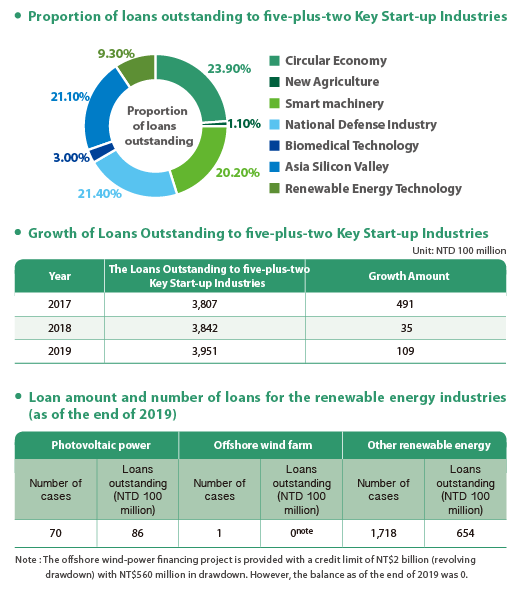

The government seeks to develop the domestic finance industry's functions for facilitating structural transformation in the economy and industrial development and it encourages loans for five-plus-two Key Start-up Industries, including Asia Silicon Valley, Smart Machinery, Renewable Energy Technology, Biomedical Technology, National Defense Industry, New Agriculture, and Circular Economy. MICB has always supported the government's major national construction projects and policies and formulated the Directions for Making Loans to Key Start-up Industries at the end of 2016 in hopes of driving investment, integrating funds, technology, and talent, and creating job opportunities and boosting economy locally. By 2019, the outstanding loan balance reached NT$395.1 billion, ranked fifth in the finance industry. MICB received Class A Award for providing loans to key innovative industries, and Special Award from the Financial Supervisory Commission, and Special Award for the Smart Machinery industries for its long-term support of small and medium enterprises from the FSC in April 2019.

Small and Medium Business Loans

The Company has long assisted small and medium businesses in obtaining working capital. The Plan for Small and Medium Business Loans was developed to help domestic small and medium businesses operate stably. As of the end of 2019, the loans outstanding reached NT$504.3 billion, an increase of NT$29.6 billion compared to the end of 2018, for 12,693 borrowers. MICB received Class A Award for providing loans to small and medium enterprises from the Financial Supervisory Commission in April 2019.

Reconstruction of Dangerous and Old Buildings and Urban Renewal

As of the end of December 2019, MICB has accumulated NT$35.561 billion in approved loans facility for urban renewal and reconstruction of dangerous and old buildings with the aim of improving the functions of cities, improving regional industrial development, and fulfilling social responsibilities for improving the quality of the environment.

As of the end of December 2019, MBF has provided loan limits totaling NT$795 million for urban renewal and reconstruction of dangerous and old buildings.

As of the end of December 2019, MAM has provided advanced funding of NT$6.117 billion for urban renewal and reconstruction of dangerous and old buildings.

Government Concessional Loan for Youth Housing

The Company has worked with Ministry of Finance to promote the Government Concessional Loan for Youth Housing. As of the end of 2019, the Company has made concessional loans to 19,752 households.

MICB has launched concessional loans in recent years with gradually decreasing gaps in interest rate with the Government Concessional Loan for Youth Housing. Customers can choose their own mortgage plan and it has led to a decrease in the number of new applications for Government Concessional Loan for Youth Housing. The Ministry of Finance has added a one-stage floating interest rate of 1.68% since 2019 to help the people plan their mortgage requirements based on the status of funding. MICB shall continue to work with government policies to promote the mortgage plan.

Reverse Mortgages

In response to aging society, MICB launched the "Happy LOHAS" reverse mortgage to help the elderly vitalize their own real estate and provide them with funding necessary for life after retirement. Marketing campaigns were launched in each quarter of 2019 and they included referral gifts for successfully referrals of relatives and friends, retirement health examination activities for wealth management customers, limited-time offer for reducing service fees by half for female customers, preferential loans for residents of elderly homes. We also used multiple channels for promotions including the official website, mobile banking, delivery of ads or SMS, and setting up booths in elderly homes. As of the end of 2019, we had processed 34 applications and approved NT$238 million in loan limits.

Mega Holdings' Epidemic Prevention and Relief Measures

The rapid spread of COVID-19 across the world in 2020 has continued to impact economic development. MICB actively cooperated with government policies to help industries and revitalize the economy. We enhanced the digital platform and mobilize the entire Bank in Taiwan and abroad to actively care about customers and execute community care actions. As of the end of April 2020, we have assisted 3,782 enterprises and individuals in applying for financial relief loans. The government relief loans and relief programs organized by MICB totaled NT$41.8 billion. MICB ranked among the first in terms of total applications and amounts which is a reflection of MICB's activeness in providing relief loans and care for customers.